STOCKS, BONDS &

FISCAL PAPER

1876

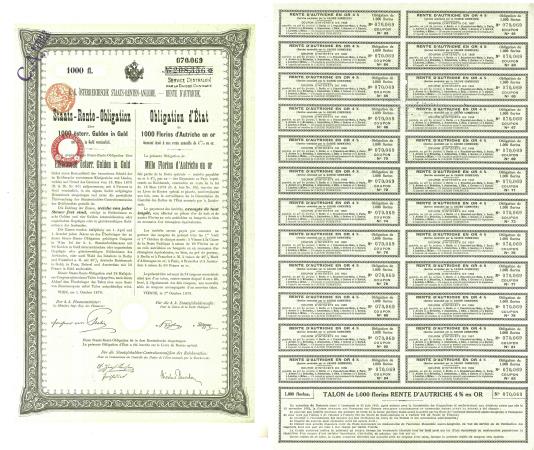

AUSTRIAN EMPIRE GOLD BOND WITH A NAZI CONNECTION

In October 1876 the Austrian Empire issued these 200 and 1000 Florin

(Gulden) perpetual 4% gold bearer bond. According to its original terms

the 200 Florin bond paid a tax-free semi-annual interest payment of 4

Austrian or Hungarian Gold Florins or 10 gold French Francs or 8.1

German Mark. The 1000 Florin bond paid five times that amount. Though

the bond may have been perpetual, governments are not. After

the collapse of the Austrian Empire following World War I the terms of

the bonds were changed. Interest would only be paid annually and the

amount would depend on the amount of funds collected from the successor

nations of the Austro-Hungarian Monarchy. In March 1938 Nazi

Germany annexed Austria and redeemed the bonds. The bonds

were put into storage at the Reichsbank in Berlin where they were

forgotten for over 75 years. The large-sized bonds measure

approximately 9.5" x 15" (24 x 38 cm) Having been

actively traded for over 60 years the bonds show moderate

wear. They are written in both German and French. Included is

a full sheet of 24 coupons, due to be redeemed from 1937 to 1960. The

bond and coupon sheet are cancelled with a single punch.

Item

BND-AT-200FL

AUSTRIA 200 FLORIN GOLD BOND 1876,

VG-F

$9.00

Item

BND-AT-1000FL

AUSTRIA 1000 FLORIN GOLD BOND 1876,

VG-F

$10.00

Item

BND-AT-BOTH BOTH OF THE ABOVE AUSTRIAN 1876

GOLD BONDS

$15.00

OLD CHINESE

LOTTERY LOAN BOND

The Republic of China issued this 5 Dollar Second Nationalist

Government Lottery Loan bond in 1926 to raise money to finance

improvements in the Port of Whampoa in Canton, (now Pazou, a section of

Guangzhou). Rather than pay interest the bonds were

automatically entered into a tri-monthly lottery that paid prizes from

$1,000 to $50,000. This made the bonds popular with the Chinese, who

are natural gamblers. The front of the bond is in Chinese,

the reverse in English. Both the front and back are

underprinted with a map of the port. The bonds specify that they are

denominated as "5 Dollars Canton Currency". At the

time the bond was issued China was involved in a three-way civil war

between Northern China, Southern China and the Communists, each issuing

its own currency, so it was necessary to specify which exactly Chinese

currency. The bond measures about 7 1/4" x 5" (18cm

x 13cm).

Item

BND-CN26-5D CHINA 5

DOLLARS 1926 LOTTERY LOAN BOND, VF-XF

$10.00

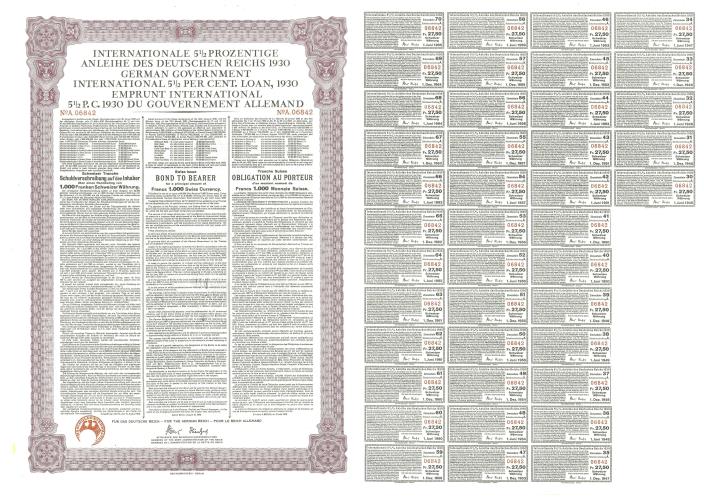

HISTORIC

1930 YOUNG PLAN BONDS ATTEMPT TO PAY GERMAN WAR

REPARATIONS

After its defeat in World War I, Germany was saddled with heavy war

reparations, the repayment of which contributed to the 1923 German

hyperinflation and helped bring Hitler to power. An attempt

was made in 1924 to restructure the payments, however that quickly

failed. A second attempt was made in 1929. The

proposal was known as the Young Plan. It was named after its

chairman, American industrialist Owen D. Young, who founded the Radio

Corporation of America (RCA) and was Chairman of General

Electric. The Young Plan reduced payments by about

20%, stretched payment out over 58 years, and created the Bank of

International Settlements to facilitate the reparation

payments. One third of the annual reparations were to be paid

by Germany from general revenue, however that payment could be

postponed. Two thirds of the annual payments were to be financed by a

consortium of American banks and were "unconditional". In

1930 bonds were issued various currencies to help implement the

plan. The plan however quickly failed. The stock

market crash of 1929, the start of the Great Depression and the

collapse of international trade made the plan infeasible. As might be

expected, the plan was unpopular with most Germans and Hitler made

repudiation of the war reparations a major element of his

campaigns. He repudiated the debt after becoming Chancellor

in 1933. After Germany's defeat in World War II the payments were again

restructured, and Germany finally paid off the last of its reparation

debt and interest in 2020, 92 years after its defeat in World War

I. We offer ab historic `000 Swiss Francs 1930

Young Plan Bond. The bonds paid 5

1/2% interest. They have texts in German, English and

French. The large sized bonds measure

approximately 11.75" x 16.5" (300 x 420mm) and have been punch

canceled. The Swiss bonds

include a partial sheet of 41 coupons, dating from June 1, 1945 to June

1 1965. They are important but rarely seen financial

instruments.

Item

BND-YOUNG-SWISS 1000 SWISS FRANCS 1930 YOUNG

BOND

VF-cancelled

$7.00

CLICK

HERE FOR WORLD WAR II COIN & CURRENCY PAGE

CLICK

HERE FOR WORLD WAR II COIN & CURRENCY PAGE

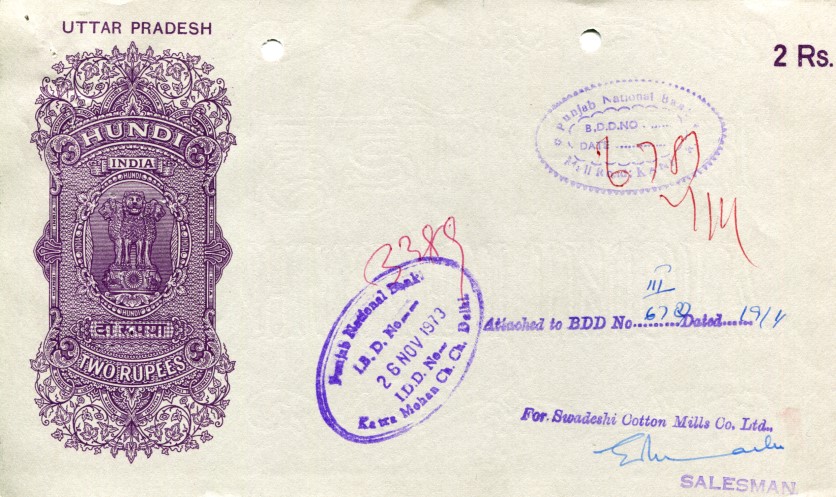

HUNDIS FROM INDIA

The Hundi is a financial instrument developed by the native bankers in

India. It can perform a variety of banking tasks.

Depending on how it is written it may act like a Bill of Exchange,

extension of credit, transfer of funds, or a travelers check. The

Indian government, seeing a lucrative source of revenue, required all

Hundis to be written on a special watermarked government form bearing a

tax imprint. We offer a set of two Hundi notes.

Included is a Hundi bearing a 2 Rupee tax imprint on a mostly blank

form that references another document, and a Hundi bearing a 1 Rupee

tax imprint that is on a pre-printed form for the Swadeshi Cotton Mills

Company Limited. The Hundis are approximately 220mm x 130mm (5.25” x

8.75”) and were issued in the 1970’s. It is an unusual financial

instrument that is rarely offered for sale.

Item

PM-HUNDI SET OF 2 INDIAN HUNDI NOTES: 1

& 2

RUPEES, CANCELLED $4.50

SOVIET

UNION LOTTERY BONDS

Opportunities for

savings or investment were severely limited in the Soviet

Union. One could put their money into the state bank which

paid 2% to 3% interest or one could buy government issued lottery

bonds. These 25 and 50 Ruble lottery bond was issued by the

Soviet

Union in 1982. Monthly drawings were held over a

20-year period. Prizes ranging from 100 Rubles to 10,000 Rubles

(or a new Volga automobile and 5000 Rubles. Over the 20-year period

approximately 32%

of the bonds would be drawn for a prize, the rest would get back their

principal. With the collapse of the Soviet Union in 1991 and

subsequent inflation, the bonds became virtually worthless.

The green bond measures 160 x 116mm. They are historic items

from the final decade of the Soviet Union.

Item

BND-USSR82-25R

USSR 25 RUBLES BOND, 1982 VF-XF

$3.75

Item

BND-USSR82-25R

USSR 25 RUBLES BOND, 1982 VF-XF

$3.75

Item

BND-USSR82-50R

USSR 50 RUBLES BOND, 1982 VF-XF

$4.50

Item

BND-USSR82-X2

BOTH OF THE ABOVE USSR 25 & 50 RUBLES BONDS, 1982

$7.00

Item

BND-USSR82-X2

BOTH OF THE ABOVE USSR 25 & 50 RUBLES BONDS, 1982

$7.00

OLD MINING COMPANY

STOCKS

Mining Companies were once the hottest, most speculative stocks around,

much like technology stocks are today. We have a collection of 8 old

mining stock certificates dating from the late 19th century to the

mid-20th century. The collection includes cancelled certificates from

Dayrock Mining Co., Goldfield Consolidated Mines Co., Marsh Mines

Consol-idated, Monitor Mining Co., Sherman Lead Co., Tamarack &

Custer Consolidated Mining Co., United States Mining Co. and an

unissued certificate of Hercules Mining Co.. The companies are all long

gone. The Goldfield, Monitor, and Tamarack certificates have

nice vignettes of miners at work. It is a fun and historic

collection that is worthy of framing.

Item

STK-MINE8 8 DIFFERENT OLD MINING CO. STOCK

CERTIFICATES

$15.00

THE MIGHTY HAVE

FALLEN - BANKRUPT BLUE CHIP STOCKS

Pan American and General Motors were once considered some of the best

and safest stocks in America - yet both companies went bankrupt leaving

shareholders with virtually nothing.

Pan American World Airways, commonly known as Pan Am, was once the

world's largest airline. Its extensive network included two

around the world routes. By 1968 its fleet of 150 jets had

scheduled passenger service to 122 airports in 86 countries on every

continent except for Antarctica. The deregulation of the airline

industry in the United States in 1978 and the growing power of foreign

rivals cut into its once thriving business. U.S. government

policies that often favored its rivals, poor management decisions,

higher fuel prices and decreased travel caused by the First Gulf War

forced the company into bankruptcy in January 1991.

In the 1960's General Motors was the world's largest automobile company

and sold over half of the cars in the United States. They

also manufactured locomotives, farm tractors, truck and boat engines

and home appliances. The company filed for bankruptcy in 2009

and had to be bailed out by the United States government.

We offer cancelled, engraved stock certificates from both of these once

great companies. The Pan American World Airways certificate

is dated from the mid 1960's to early

1970's. The red certificate for 100 Shares and has the facsimile

signature of its founder Juan Tripp who was the Chairman from 1927

until 1968. Its beautiful vignette includes

an eagle over two allegorical men and globes of the

world. The General Motors stock certificate is

dated between the 1960's and the 1980's and has a vignette that includes a futuristic car,

truck and locomotive. Both serve as a reminder that hot stocks

sometimes turn ice cold.

Item

STK-PAN-AM PAN AMERICAN WORLD AIRWAYS STOCK CERTIFICATE, 100 SHARES, Cancelled, slight tear

$5.00

Item

STK-GM1 GENERAL MOTORS STOCK CERTIFICATE Cancelled

$5.00

<--

PREVIOUS

PAGE NEXT PAGE -->

CLICK

HERE FOR WORLD WAR II COIN & CURRENCY PAGE

CLICK

HERE FOR WORLD WAR II COIN & CURRENCY PAGE

Item

BND-USSR82-25R

USSR 25 RUBLES BOND, 1982 VF-XF

$3.75

Item

BND-USSR82-25R

USSR 25 RUBLES BOND, 1982 VF-XF

$3.75 Item

BND-USSR82-X2

BOTH OF THE ABOVE USSR 25 & 50 RUBLES BONDS, 1982

$7.00

Item

BND-USSR82-X2

BOTH OF THE ABOVE USSR 25 & 50 RUBLES BONDS, 1982

$7.00